Introduction to the 50/30/20 Budget Rule

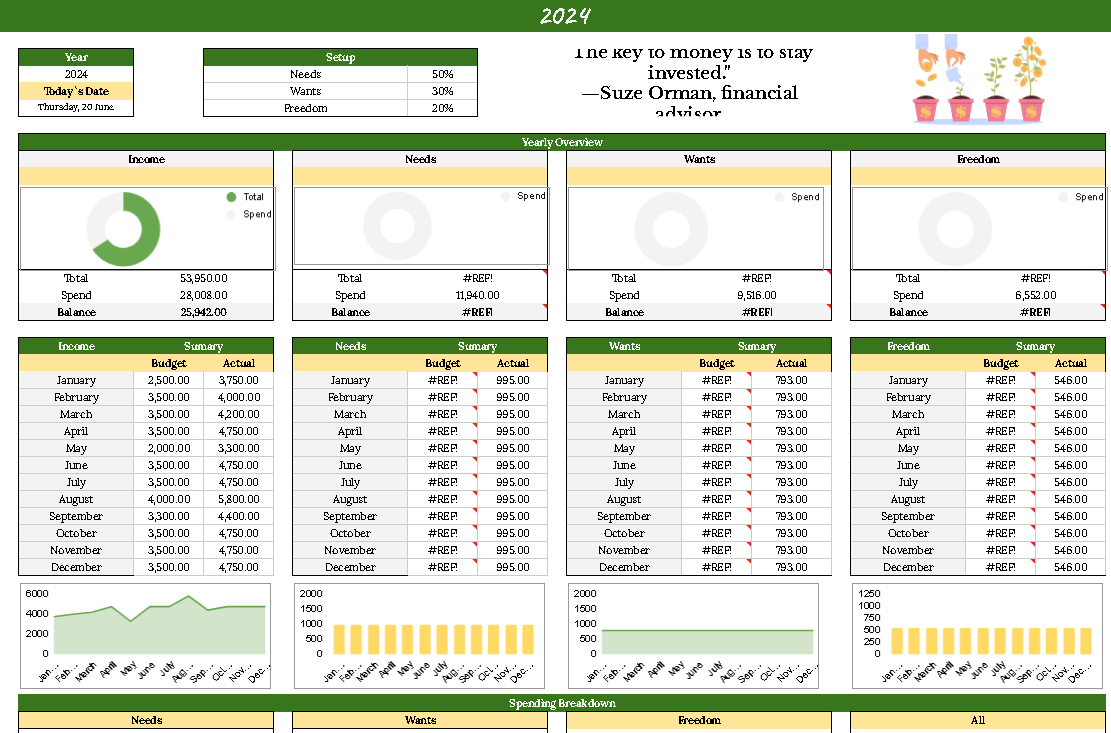

The 50/30/20 budget rule is a simple and effective financial strategy that divides your income into three categories: needs, wants, and savings. By allocating 50% of your income to needs, 30% to wants, and 20% to savings, you can maintain a balanced and healthy financial life. The Annual 50/30/20 Budget Tracker is a tool designed to help you implement this rule effectively throughout the year.

Features of the Annual 50/30/20 Budget Tracker

The Annual 50/30/20 Budget Tracker offers numerous features to streamline your budgeting process. It includes a detailed breakdown of monthly and annual expenses, allowing you to monitor your spending patterns over time. The tracker also provides customizable templates, making it easy to adjust the categories to fit your unique financial situation. Additionally, it offers visual aids such as graphs and charts to help you understand your financial health at a glance.

Benefits of Using the Annual 50/30/20 Budget Tracker

Using the Annual 50/30/20 Budget Tracker can significantly improve your financial management skills. By adhering to the 50/30/20 rule, you can ensure that your essential needs are met while still allowing room for discretionary spending and savings. This balanced approach reduces financial stress and promotes long-term financial stability. Furthermore, the tracker’s visual aids and detailed reports provide valuable insights into your spending habits, enabling you to make informed financial decisions.

Conclusion

The Annual 50/30/20 Budget Tracker is an invaluable tool for anyone looking to manage their finances more effectively. By following the 50/30/20 budget rule and utilizing this comprehensive tracker, you can achieve financial balance and security. Start using the Annual 50/30/20 Budget Tracker today to take control of your financial future.