About Dipaculao

Beyond the vibrant surfscape of Baler is the laid back town of Dipaculao in the north, a town blessed with panoramic beaches, mountains, caves, waterfalls, river systems and more.

Dipaculao has recently been in the spotlight due to its proximity to the famed capital of Aurora which is just about an hour away. Its serenity makes it an ideal escape from the busy scenes of Sabang.

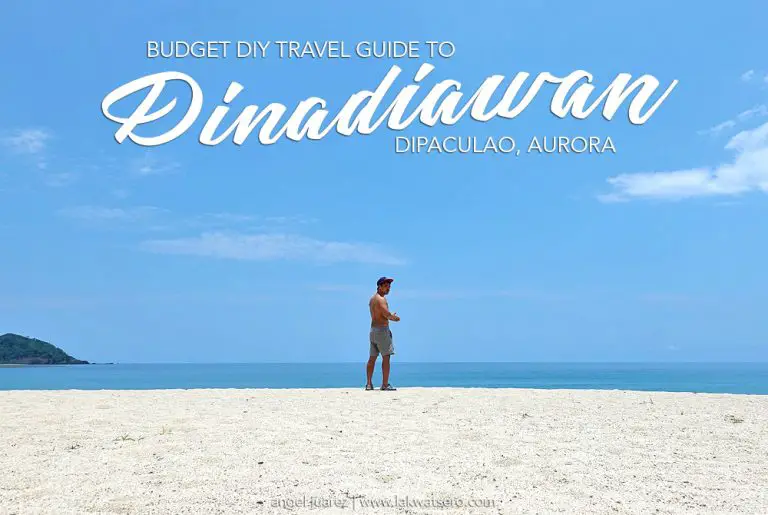

Dipaculao’s most popular spot is the long stretch of sandy beach in Barangay Dinadiawan. The cream sand Dinadiawan Beach reflects white under sunlight and with its beautiful turquoise water make a beautiful postcard image of the town.

Aside from Dinadiawan Beach, the town also boasts of other natural spots such as Aleman Falls that lies along Dinadiawan River Protected Landscape, Baul Falls, Panindiga (Dinadiawan) Falls, Bulangan Falls, Ampere Beach and Rock Formation, Dibutunan Twin Cave, Mount Dabukid, Mount Dimanjotol, Mount Pungugupanunga and more.

Dipaculao is more than just a side trip, a day spent in this town is a worthwhile experience.

How to Get to Dinadiawan

Via Baler

Manila to Baler

Joy Bus has at least four trips daily at 12AM, 1AM, 2AM and 5:30AM, travel time is around five hours and fare is P750 (November 2018 rate), advance reservation is required. Meanwhile, the regular aircon bus has published schedule of departure every hour from 2AM to 8AM but this schedule also depends on the volume of passengers, travel time is about seven hours for a fare of P450, advance reservation is not necessary.

For advance reservation on Joy Bus and other information, call their Cubao Office at (02) 709-0803 or (02) 421-1425. You can also book your bus or private transfer from Manila to Baler or vice versa below:

Baler to Dinadiawan

Dipaculao is the neighboring town of Baler to the north. You can take a trike from Baler to get to Ampere Beach and Dibutunan which are near Baler but Dinadiawan is quite far thus bus and van are the common method of transport.

To get here to Dinadiawan, catch a D-Liner bus at Baler Central Terminal going to going to Casiguran and get off at Dinadiawan. There are multiple departures daily from as early as 5AM to as late as 3PM (schedule is subject to change and depends on foot traffic). Travel time by public bus from Baler to Dinadiawan is about two hours and fare is not more than P100.

Alternatively, you may also take a van bound for Casiguran, Nagtipunan or Madella which will pass by Dinadiawan but you will have to pay the full fare. Baler to Casiguran full fare is P200, while Baler to Nagtipunan or Maddela is P300. Ask the driver to drop you off at Dinadiawan, travel time is around 1.5 hours.

Via Cabanatuan

Manila to Cabanatuan

Another alternative of going to Dinadiawan is via Cabanatuan City, Nueve Ecija. Several bus lines ply from Pasay, Avenida, Cubao and Caloocan to Cabanatuan daily including Genesis Transport, Five Star Bus, Baliwag Transit and ES Transport. Travel time is approximately three hours and fare is at least P202 (November 2018 rate). There are also vans servicing Manila to Cabanatuan.

You can book your bus from Manila to Cabanatuan or vice versa below:

Cabanatuan to Dinadiawan

Buses and vans from Metro Manila stop at Cabanatuan Central Terminal where D’Liner buses to Casiguran are also stationed. D’Liner has schedule departures at 2AM, 3AM, 5AM and 7AM but schedule may change due to various factors. The bus will pass by Baler and Dipaculao, ask the driver to drop you off at Dinadiawan which is around five to six hours away, fare is approximately P300.

Via Nagtipunan or Maddela (Quirino)

Where to Stay in Dipaculao

Accommodations in Dipaculao Area

Amansec Beach Resort

Dinadiwan, Dipaculao, Aurora

Contact No: +63918-2528665

Costa Alexa

Dinadiwan, Dipaculao, Aurora

Contact No: +63922-8336024

Costa Inesita

Dinadiwan, Dipaculao, Aurora

Contact No: +63906-5869212 / +63919-3131316 / +63922-8313139

Dinadiawan Agri Beach Resort

Dinadiwan, Dipaculao, Aurora

Contact No: +63949-4496987 / +63917-9159270

Diva Sunrise Beach Resort

Sitio Ngas-ngas, Dinadiawan, Dipaculao, Aurora

Contact No: +63932-3090941 / +63995-9535526

Doña Luz Dinadiawan

Dinadiwan, Dipaculao, Aurora

Contact No: +63917-1432936

Elysian Sands

Dinadiwan, Dipaculao, Aurora

Contact No: +63995-1075120

La Sunshine Beach Resort

Sitio Ngasngas Dinadiawan, Dipaculao, Aurora

Contact No: +63917-6618802

Pacific Villa

Dinadiawan, Dipaculao, Aurora

Contact No: +63927-5726226

Pearl White Resort

Dinadiawan, Dipaculao, Aurora

Contact No: +6315-7295907 / +63921-537348 / +63927-7160208

Porto Novo Hotel

Dinadiwan, Dipaculao, Aurora

Contact No: +63925-8773322

Radie Beach Resort

Sitio Ngasngas, Dinadiwan, Dipaculao, Aurora

Contact No: +63905-5293397

Rock and Sand Beach Resort

Sitio Kipit, Dinadiwan, Dipaculao, Aurora

Contact No: +63996-9643698

Teresitas Resort

Lower Bulos, Dinadiwan, Dipaculao, Aurora

Contact No: +63915-1114004

White Plains Cottages

Lower Bulos, Dinadiwan, Dipaculao, Aurora

Contact No: +63908-5526666 /+63926-8345155

Accommodations in Baler Area

If you prefer to stay in Baler, here are the recommended places of stay:

Top-Rated / Highly Recommended Accommodations in Baler

Costa Pacifica Resort |

Baler Fiore del Mare |

Chamie’s Transient House |

Baler Darshans Guesthouse |

Top-Rated Budget Accommodations in Baler

Go Surfari House |

The Circle Hostel |

Top Things to Do in Dipaculao

- Go beach hopping and visit Dinadiawan (Dipaculao) Beach, Bungan Beach, Disagadan (Dibutunan) Beach and Ampere Beach and Rock Formation

- Chase waterfalls: Aleman Falls, Baul Falls, Panindiga (Dinadiawan) Falls and Bulangan Falls

- See Dibutunan Twin Cave

- Climb Mount Dabukid, Mount Dimanjotol or Mount Pungugupanunga

- Explore the beaches and attractions of Dinalungan and Casiguran

- Surf and discover the many wonders of Baler

Sample Weekend Budget Itinerary in Dipaculao & Baler

Estimated budget: P3,500 per person (for two-person sharing)

Day 1:

0000H: Assembly in Cubao

0100H: Cubao to Baler

0700H: Arrival in Baler | Breakfast | Transfer to van to Dinadiawan

0900H: Arrive in Dinadiawan | Proceed to Hotel / Accommodation | Rest

1000H: Free Time: Proceed to Aleman Falls / Baul Fals

1300H: Back in Dinadiawan | Lunch | Rest

1500H: Free time: Swim, Beach Games

1700H: Wash-up | Fix-up

1800H: Dinner / Socials

Day 2:

0530H: Call Time | Sunrise

0630H: Breakfast | Check-out | Depart for Baler

0830H: Arrive in Baler | Proceed to Sabang | Surfing Session

1100H: Wash-up | Fix-up | Rest

1200H: Buffet Lunch at Chef Jerry Shan

1400H: Proceed to Bus Station

1500H: Bus: Baler to Cubao

2230H: Arrival in Cubao

Breakdown of Expenses

| Particulars | Cost |

| Bus: Manila to Baler | P750/person |

| Van to Dinadiawan | P200/person |

| Accommodation | P1500/night (2-person sharing) |

| Trike to Aleman Falls | P200/trike (3-person sharing) |

| Miscellaneous Expenses (food, souvenirs, personal expenses, etc.) | ~P700/person |

| Van to Baler | P100/person |

| Surfing session with instructor (1 hour) | P350/person |

| Bus: Baler to Manila | P750/person |

Source: Lakwatsero

Image Source: Lakwatsero